Adverts

IPVA 2022 is coming, for several states. But to ensure the peace of mind and safety of drivers, here at Hipercurioso, we have already started talking about the subject. All this because we want to help you prepare up front. In fact, right here in this article you will find some links with several tips.

IPVA is the acronym for Motor Vehicle Property Tax. Ultimately, a tax of a state nature, but with the objective of collecting revenue from vehicles, regardless of the type of automobile it is. This includes, for example, motorcycles, cars, buses, trucks, etc.

About the IPVA 2022 exemption, let's give that strength to those famous questions: Am I entitled? Why? Who can claim the exemption? Let's speed up on this matter because today there will be no doubt about it. First, let's talk about the categories that are exempt.

Drivers who have their vehicle as their main work tool fall into this category. That is, taxi drivers, motorcycle taxi drivers, train drivers, school bus drivers, and operators of agricultural machinery such as, for example, tractors.

By the way, look what a good thing: The IPVA exemption, for those mentioned above, happens automatically. But attention! Every year you have to keep an eye out to check if your automatic approval really happened. Otherwise, you should look for your state's Detran to regularize your situation.

The exemption also happens due to the year of manufacture of the car. So, if your vehicle has been running for at least 10 years, it may be exempt from IPVA. And why do we say “at least”? Because your exemption depends on each state. That is, it can come when your vehicle turns 10, 15 or 20 years old.

Adverts

That is, currently, in these states, cars manufactured until 2011 are already exempt from the tax.

Therefore, the list of states in this category is already much longer (thank goodness!). Finally now currently:

In other words, in the 2022 IPVA, only models from 2002 are exempt from the tax.

As well as their year of manufacture, some drivers guarantee exemption from IPVA for People with Disabilities (PCD). So, below is the list to find out who fits:

Above all, to guarantee the rights of those who fall into this category, proof is required through a medical report. In addition, this report needs to be done in a clinic accredited by the DMV in your state.

Furthermore, if necessary, the vehicle needs to be adapted for the driver. The car must be inspected by the Detran, in order to verify the efficiency of the adaptation of the car, personalized for its main driver.

In addition to the Exemption, however, there are two other situations where the right not to pay IPVA 2022 exists. Namely, they are the categories of Immunity and Dispensation. By the way, let’s talk about them below:

Certainly, some individuals are just like that: Exempt from paying the tax by institutional law, such as people demonstrably affiliated with:

By analogy, the driver is exempt from paying the IPVA for some very specific reasons. Just to exemplify, let's name a few:

Since IPVA 2022 has arrived, be aware if you fall into any exemption category. Likewise, you have the right not to pay tax due to Immunity or Dispensation. Go after your rights! We hope these incredible tips help you plan for paying – or not – this tax.

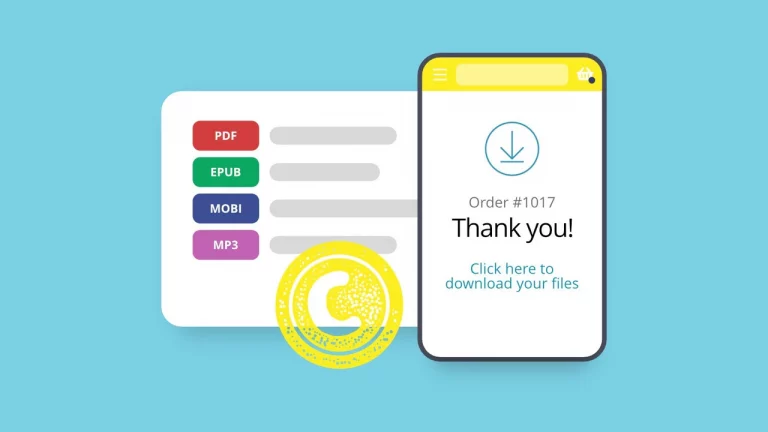

A great app that can help you consult an estimate of the value of your tax, based on your state and your vehicle, using your license plate is IPVA 2022 itself, available for you to download and install directly on your phone, now that it is available on the official Google Play platform.

In short, with it, you can check your value and your IPVA calendar through your license plate. In addition, you can search for your car in the Fipe table and even compare the price of ethanol and gasoline in your car. Finally, still know where to pay your IPVA, in case you discover that it is not exempt. Share!